Shipping your car can be a practical, stress-saving alternative to driving it over long distances — but before handing over your keys, it’s vital to understand what kind of protection your vehicle has while in transit.

Whether you’re relocating across the country, buying a classic car from another state, or sending a vehicle to a family member, knowing how car shipping insurance works can save you from potential financial surprises.

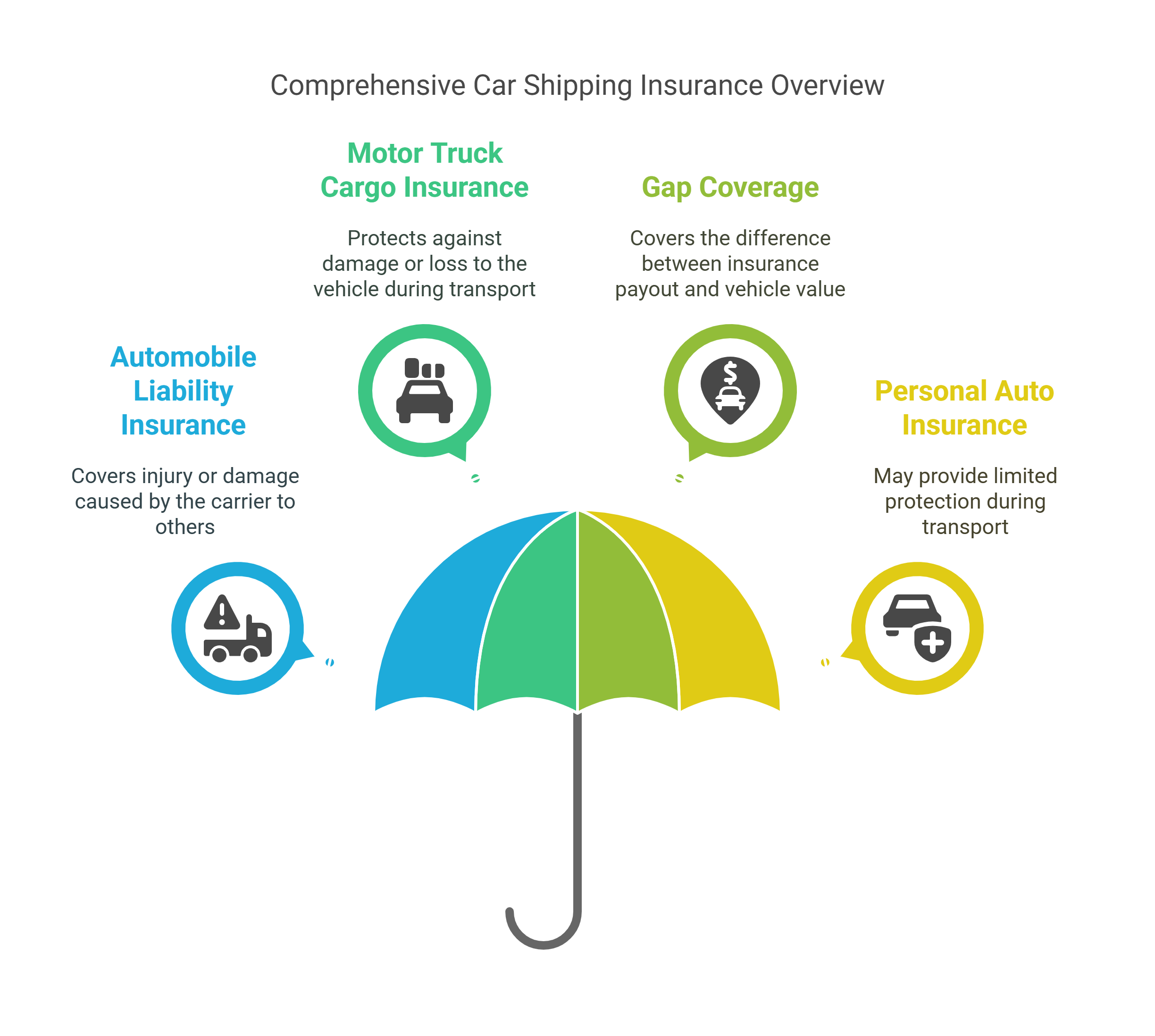

Most professional auto transport insurance policies are designed to cover your car against accidental damage, theft, or other unforeseen issues while it’s being moved from one location to another. However, not all policies offer the same level of protection — and understanding the difference between carrier liability insurance, motor truck cargo Insurance and optional gap coverage is essential.

This guide will break down everything you need to know about auto transport insurance requirements so that you are fully equipped. It will cover the types of coverage, what it typically costs, and expert tips for protecting your vehicle before, during, and after shipping.

Key Takeaways

- Automobile Liability Insurance: All auto transport carriers are legally required to carry automobile liability insurance, but coverage limits and specifics can vary. At Sherpa, we require all of our carriers to hold at least $1,000,000 in liability coverage.

- Motor Truck Cargo Insurance: Many car shipping companies must carry Motor Truck Cargo Insurance – this is the one you care about most as the car owner. At Sherpa, we require every carrier we use to have at least $100,000 in coverage.

- Additional Coverage Options: It includes supplemental insurance, such as gap coverage.

- Personal Auto Insurance: Your existing auto insurance policy may offer limited coverage during shipping; it’s essential to verify the details with your provider.

- Choosing a Reputable Transport Company: Partnering with a trusted company like Sherpa Auto Transport ensures compliance with insurance requirements and provides peace of mind.

In This Guide:

- Do You Need Insurance to Ship a Car?

- Types of Car Shipping Insurance

- Shipping Insurance Cost

- Tips for Transporting a Vehicle

- Why Choose Car Shipping Instead of Driving?

- Bottom Line

- Car Shipping Insurance FAQ’s

Do You Need Insurance to Ship a Car?

When preparing to transport your vehicle, one of the most common questions customers ask is whether they need insurance. The short answer is yes — and no. While federal law requires all auto transport carriers to carry automobile liability insurance, it’s crucial to understand what this coverage actually includes.

Automobile liability insurance is designed to cover injury or damage caused by the truck/driver to others (people or property) during the shipping process.. At Sherpa, we require every carrier contracted to hold at least $1,000,000 in automobile liability coverage.

The insurance that most customers need to be aware and concerned about is motor truck cargo insurance. This typically includes coverage for external damages, such as dents, scratches, or other physical harm caused by accidents during loading, unloading, or transit.

However, this type of insurance often has limitations and deductibles. For example, it will not cover personal items left in the vehicle, pre-existing damage or acts of God.

What many vehicle owners don’t realize is that motor truck cargo coverage comes with caps, exclusions, and deductibles that vary between companies. This is why it’s always wise to ask for a copy of the transporter’s Certificate of Insurance (COI) once a carrier has been assigned.

Review the coverage limits, what’s included, and any situations that might not be covered. In some cases, it’s advisable to purchase supplemental auto transport insurance from a third-party provider or your own insurance company, especially if you’re shipping a high-value, luxury, classic, or collectible car.

These additional policies can offer broader, more comprehensive protection, including coverage for theft, weather-related damage, and incidents that might fall outside of a standard carrier’s liability and motor truck cargo policy.

Can You Transport a Car Without Insurance?

Technically, you can transport your car without purchasing extra car transport insurance and without having a personal auto insurance policy on the vehicle. Every professional auto transport carrier in the U.S. is legally required to carry liability coverage.

However, relying solely on the carrier’s policy might leave you under-protected, especially if the coverage limit is lower than your car’s value or if it excludes specific risks that could occur during transport.

For instance, while the carrier’s insurance may cover external damage to the vehicle during shipping, it usually won’t protect personal belongings inside the car or cover minor cosmetic issues that aren’t documented on the pre-shipping inspection report.

Additionally, motor truck cargo insurance typically only covers damage for which the transporter is legally responsible — not damage caused by unforeseen events like acts of God, road debris, illegal or prohibited goods, or delays in transit.

To stay fully protected and have peace of mind, it’s a smart move to:

- Verify the carrier’s insurance coverage details upfront. When using Sherpa you can rest assured knowing your assigned carrier will have at a minimum $1,000,000 in liability coverage and $100,000 in cargo coverage

- Check your personal auto insurance policy to see if it extends to vehicle transport situations

- Consider purchasing supplemental insurance if your vehicle is particularly valuable or if you want extra protection for potential risks not covered by the carrier

Ultimately, while extra insurance isn’t always mandatory, it’s often a worthwhile investment to safeguard your vehicle during transit — especially when you consider the potential repair or replacement costs should something go wrong.

Types of Car Shipping Insurance

When shipping your vehicle, it’s important to understand the different types of car shipping insurance available. Not every policy covers the same risks, and knowing the options will help you choose the right protection for your vehicle’s journey. Below are the main types of auto transport insurance to consider:

Automobile Liability Insurance

This is the baseline coverage that all auto transport carriers in the United States are required by law to carry. It covers injury or damage caused by the truck/driver to others (people or property) during the shipping process.

Key Points:

- Mandatory for all professional carriers

- Coverage limits vary by company but Sherpa requires all carriers to hold at least $1,000,000 in Liability Coverage — always ask for a copy of the transporter’s Certificate of Insurance (COI) once a carrier has been assigned for your shipment.

- Does not cover damage to the vehicle

Because of these limitations, many vehicle owners seek additional coverage for complete peace of mind.

Motor Truck Cargo Insurance

Motor Truck Cargo insurance provides protection for your vehicle against damage or loss during transport, regardless of who is at fault. This coverage applies to collision, fire, and load shifting or accidents in transit.

Key Points:

- The most important coverage for customers as it applies to the cargo itself — in this case, the vehicle being transported

- May cover theft, fire, collision, vandalism, and load shifting or accidents

- Policy limits and exclusions still apply — verify what’s included before committing

- Sherpa requires all contracted carriers to hold a minimum of $100,000 in motor truck cargo insurance

If your car is particularly valuable or sentimental, it’s wise to view and understand the limits of your carrier’s motor truck cargo insurance policy.

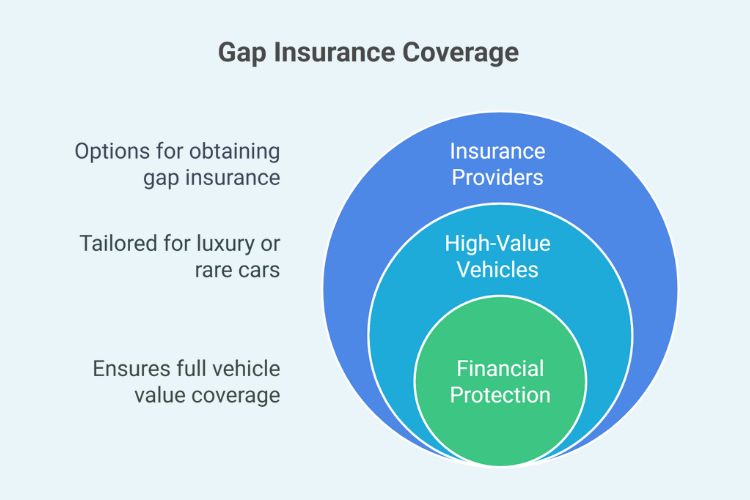

Gap Coverage

Gap insurance is designed to cover the difference between the transport carrier’s insurance payout and the actual market value or replacement cost of your vehicle if it suffers total loss or significant damage. This type of insurance is particularly useful for owners of high-value, classic, luxury or rare vehicles where the standard carrier liability might fall short.

Key Points:

- Protects against financial shortfall if the carrier’s insurance doesn’t fully cover your car’s value

- Useful for vehicles valued higher than average policy limits

- Often available through your personal insurer or a specialty insurance company

Personal Auto Insurance

In some cases, your existing personal car insurance policy might provide limited protection while your vehicle is being transported. This varies widely depending on your insurer and policy details, so it’s important to check your coverage before shipping.

Key Points:

- May extend partial coverage during transport

- Usually secondary to the carrier’s liability insurance

- Could cover certain risks like vandalism or theft while in transit

- Speak to your insurance provider to confirm whether this applies to your policy

Once you understand these insurance types not only will it help you assess your risk, but also enables you to make smarter, more informed choices when arranging your vehicle’s transport. If you’d like to learn more about different transport options, be sure to visit Sherpa’s guides on open car transport and enclosed auto transport to find the right fit for your vehicle.

Shipping Insurance Cost

The cost of Automobile Liability Insurance and Motor Truck Cargo Insurance is included in the quote provided by Sherpa Auto Transport. The cost of additional car shipping insurance depends on several important factors, and it’s helpful to understand what affects pricing before committing to a shipping service. The overall cost is typically influenced by the following:

- Vehicle Value: High-value or luxury vehicles often come with higher insurance premiums because of the increased financial risk involved in transport.

- Shipping Distance: Longer shipping distances increase the risk exposure for the carrier, which can slightly raise insurance costs.

- Type of Transport: Choosing enclosed auto transport — which offers added protection against weather and road debris — often includes higher insurance coverage but at a premium compared to open car transport.

- Type of Insurance: Basic carrier liability insurance is generally included in the quoted shipping price. However, adding supplemental coverage like cargo insurance or gap coverage can result in additional fees.

For most standard transports, additional insurance coverage costs can range between $50 to $500, depending on the vehicle’s value and the total shipping distance. If you’re transporting a classic or luxury car, insurance costs may be higher due to the vehicle’s elevated market value.

Pro Tip:

Always request a breakdown of what’s included in the quote. Confirm whether the listed price covers just the basic liability or includes extra insurance options. It’s also smart to compare quotes from multiple transport companies, factoring in both shipping and insurance options.

Sherpa Auto Transport provides clear, upfront pricing and verified insurance information to help you make an informed decision.

Tips for Transporting a Vehicle

A bit of preparation can go a long way in ensuring a stress-free auto transport experience. Here are some helpful tips to make your vehicle shipping process smooth and hassle-free:

- Research Auto Transport Companies

Choose reputable, well-reviewed transport providers with verified licensing and insurance credentials. Look for customer feedback on independent review platforms, and consider guides like how to ship a car for expert recommendations. Before booking, confirm the company’s licensing by checking their USDOT number and MC number, which verify their authority to operate legally. - Verify Insurance Coverage:

Before shipping your vehicle, ask the transport company for a copy of their Certificate of Insurance (COI). Confirm coverage limits, deductibles, and what incidents are covered. - Document Vehicle Condition:

Thoroughly inspect your vehicle before shipping. Take high-resolution photos from multiple angles, noting any scratches, dents, or imperfections. This documentation can serve as crucial evidence in the rare event of a damage claim. - Remove Personal Items:

Clear out any personal belongings, aftermarket electronics, and loose accessories from the vehicle’s interior. Most insurance policies exclude personal items, and unsecured objects could cause damage during transit. - Understand the Contract:

Read the transport agreement carefully. Pay attention to terms regarding insurance coverage, liability exclusions, payment terms, and claims procedures. Ask questions if anything is unclear.

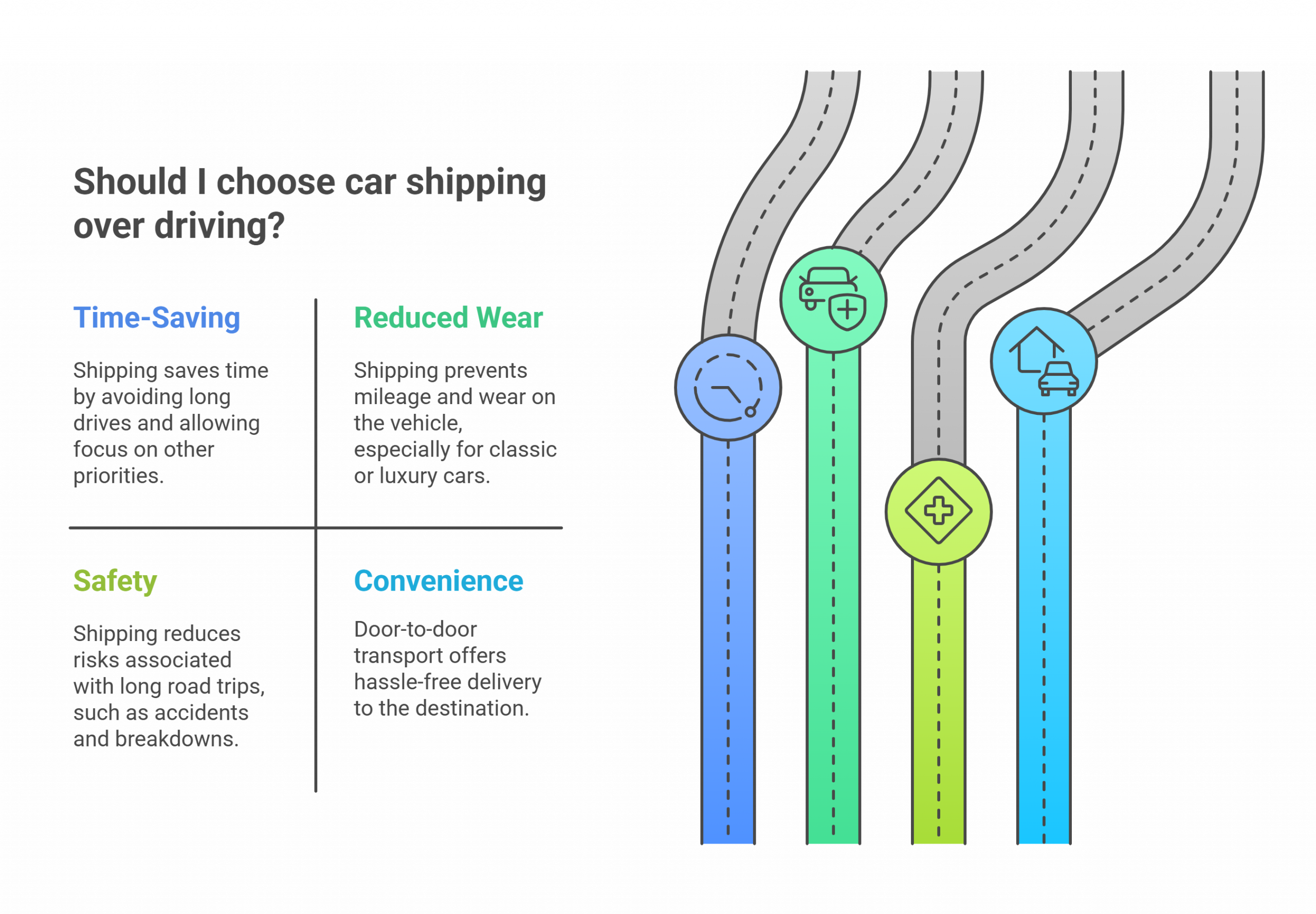

Why Choose Car Shipping Instead of Driving?

Opting for professional car transport services offers several compelling advantages over driving your vehicle long distances:

- Time-Saving:

Cross-country drives can take days or even weeks, especially if you factor in breaks, weather, and overnight stays. Car shipping frees up your time, allowing you to travel by air or focus on other priorities. - Reduced Wear and Tear:

Avoid adding unnecessary mileage and strain to your vehicle, especially if it’s a classic, luxury, or high-mileage car. Long-distance drives can lead to tire wear, oil degradation, and increased maintenance needs. Shipping your vehicle on a car hauler also reduces the risk for damage that towing a car might bring. - Safety:

Long road trips involve risks like accidents, vehicle breakdowns, and unpredictable weather. Professional transport services reduce those risks by safely and efficiently transporting your vehicle. - Convenience:

With the availability of door-to-door transport options, you can have your vehicle picked up from your current location and delivered directly to your destination without logistical headaches.

Bottom Line

Understanding car shipping insurance is an essential part of safeguarding your vehicle while it’s in transit. From grasping the types of coverage available — such as Automobile liability insurance, motor truck cargo insurance, and gap coverage — to confirming your transport provider’s insurance credentials, taking these steps ensures a smoother, worry-free shipping process.

When you choose a trusted, professional transport service like Sherpa Auto Transport, you gain peace of mind knowing your vehicle is in experienced hands, backed by reliable insurance coverage. Whether you’re moving cross-country, buying a vehicle from another state, or sending a car to a loved one, Sherpa’s transparent pricing and proven service make it easier than ever to ship your vehicle.

Car Shipping Insurance FAQ’s

Should you get insurance when shipping a car?

Yes, carriers have mandatory automobile liability insurance and motor truck cargo insurance. Obtaining additional coverage can provide comprehensive protection for your vehicle but is often unnecessary.

Is it worth getting additional shipping insurance?

Sometimes. Supplemental insurance offers peace of mind and financial protection against potential damages not covered by automobile liability insurance and motor truck cargo insurance. Typically for higher value, or truly sentimental vehicles, an additional policy during transit can help ease any concerns.

What to do before shipping your car?

Document your vehicle’s condition, verify the carrier’s insurance coverage, and remove personal items to prepare for shipping. Check out our vehicle shipping tips for more information on how to prepare your vehicle for shipping.